The akhuwat foundation official website is the primary digital reference point for anyone seeking accurate, verified, and ethical information about interest-free loans in Pakistan. In a landscape crowded with misleading pages and unofficial platforms, understanding how to identify and use the official source is not optional; it is essential.

With more than 20 years of experience documenting nonprofit organizations, microfinance institutions, and public-interest financial systems, I can state this with certainty: when it comes to Akhuwat, clarity protects applicants. This complete overview explains what the akhuwat foundation official website offers, what it does not offer, and how users should rely on it responsibly in 2025.

What Is the Akhuwat Foundation Official Website

The akhuwat foundation official website is the digital representation of Akhuwat Foundation, a nonprofit organization established in 2001 to provide Qarz e Hasna, meaning interest-free loans, to underserved communities.

The website exists to:

- Share official information

- Explain loan programs

- Publish organizational updates

- Provide contact and branch details

- Offer application guidance

It is not designed for instant approvals or commercial transactions.

Why the Akhuwat Foundation Official Website Matters

In recent years, the rise of unofficial loan portals has caused confusion and financial harm. The akhuwat foundation official website acts as the single source of truth for policies, processes, and public communication.

Key reasons it matters:

- Protects applicants from fraud

- Ensures process transparency

- Maintains organizational credibility

- Aligns with ethical finance principles

For anyone researching akhuwat foundation official website, understanding its role prevents costly mistakes.

Core Sections of the Akhuwat Foundation Official Website

The structure of the akhuwat foundation official website is intentionally simple and informational.

About Akhuwat Foundation

This section explains:

- Organizational mission

- Islamic principles behind Qarz e Hasna

- History since 2001

- Nationwide impact across Pakistan

It establishes trust, experience, and social legitimacy.

Loan Programs and Services

The akhuwat foundation official website clearly outlines loan categories without marketing exaggeration.

Major programs include:

- Family Enterprise Loans

- Education Loans

- Health Loans

- Marriage Loans

- Housing Loans

- Liberation Loans

Each program description focuses on purpose, eligibility, and social impact, not sales language.

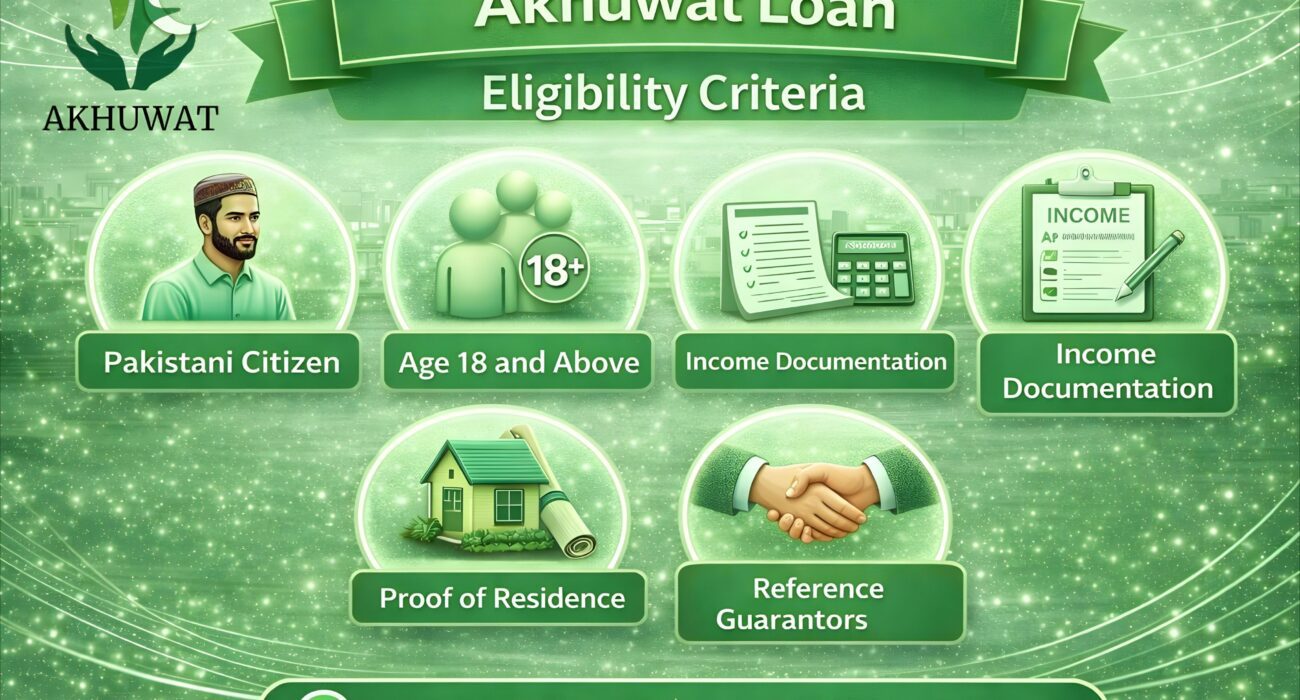

Loan Eligibility Information

The website explains akhuwat loan eligibility in practical terms.

General eligibility includes:

- Pakistani citizenship

- Valid CNIC

- Age between 18 and 62

- Belonging to a low-income household

- Ability to repay monthly installments

- Two non-family guarantors

No automated scoring or online approval claims are made.

Understanding the Loan Application Guidance

One of the most misunderstood aspects of the akhuwat foundation official website is its application guidance.

What the Website Helps With

- Explaining how to apply

- Listing required documents

- Clarifying branch-based submission

- Educating applicants before visiting a branch

What the Website Does Not Do

- No online loan approval

- No CNIC upload for approval

- No fee-based processing

- No guaranteed disbursement

This distinction protects users from false expectations.

Branch Network and Physical Presence

Akhuwat operates through hundreds of branches across Pakistan. The akhuwat foundation official website provides updated information about:

- Branch locations

- Regional offices

- Contact numbers

- Working hours

Applications are processed only through these branches, reinforcing Akhuwat’s community-based model.

Loan Verification and Approval Process

The website explains that Akhuwat follows a human-centered verification process.

Verification Stages Explained

- Initial counseling

- Social appraisal

- Household verification

- Community references

- Approval committee review

- Disbursement ceremony

This process ensures fairness, accountability, and repayment discipline.

Transparency and Ethical Standards

The akhuwat foundation official website emphasizes transparency in every aspect.

Key ethical commitments include:

- Zero interest

- No hidden charges

- No collateral

- No political influence

- Respect for borrower dignity

These standards are not marketing claims; they are operational principles.

Akhuwat Foundation Online Portal and Digital Use

The website may reference online portals for limited purposes such as:

- Audit information

- Status tracking

- Public reports

These tools support information access, not automated loan decisions. Any platform claiming otherwise is not aligned with the official website.

How to Safely Use the Akhuwat Foundation Official Website

Applicants and researchers should use the akhuwat foundation official website responsibly.

Best practices include:

- Relying on it for information only

- Confirming details at branches

- Avoiding third-party payment requests

- Reporting suspicious claims

Using the website correctly ensures safety and clarity.

Internal Reference for Loan Seekers

If you are researching loans, treat the akhuwat foundation official website as your internal reference hub. It complements, but does not replace, in-person engagement with Akhuwat staff.

This approach aligns with Akhuwat’s ethical lending philosophy.

Common Misconceptions Addressed

Based on years of observation, these misconceptions persist:

- Belief in online instant approval

- Expectation of large unsecured loans

- Confusion about fees

- Trust in unofficial portals

The akhuwat foundation official website actively counters these misunderstandings through clear communication.

Why Akhuwat Maintains a Non-Commercial Website Model

Unlike commercial lenders, Akhuwat avoids aggressive digital funnels. The website reflects:

- Simplicity

- Integrity

- Human connection

- Social accountability

This design choice is intentional and aligned with nonprofit values.

Final Conclusion

The akhuwat foundation official website is a trust anchor in Pakistan’s interest-free microfinance ecosystem. It exists to inform, guide, and protect—not to sell or pressure.

Applicants who rely on the akhuwat foundation official website for accurate information, then follow the official branch-based process, experience clarity and confidence throughout their journey.

In an environment filled with noise and misinformation, the official website stands as a reminder that ethical finance works best when trust comes first.